Bonus-Malus or Clean Car Subsidy? The South Korean Case

Abstract

Using a computable general equilibrium model, this paper compares the macroeconomic consequences of two clean car policies in South Korea. The Korean Government planned to introduce a tax-subsidy plan (2014 tax-subsidy plan) promoting low greenhouse gas (GHG) emission car (clean car) sales in 2015. This policy was replaced with a subsidy-only plan after a government-sponsored study in 2014 claimed that this policy would cause significant production and employment loss in the auto industry, without much GHG reduction. This argument was, however, solely based on partial equilibrium analysis, and failed to consider the potential revenue-recycling effect of the 2014 tax-subsidy plan. By applying a simple computable general equilibrium (CGE) model, we found that the revenue-recycling effect of the 2014 tax-subsidy plan was large enough to compensate for the negative shock to the auto industry. With reasonable values of elasticity of substitution parameters, we found that the 2014 tax-subsidy plan could increase the gross domestic product (GDP) by 0.104% while the clean car subsidy program that replaced 2014 tax-subsidy plan would cause a GDP loss of 0.015%. Our results suggest that the policy swap from the 2014 tax-subsidy plan to the 2015 subsidy-only policy may have done more harm than good to the Korean economy.

초록

본 논문에서는 일반균형모형을 활용하여 2014년에 도입 연기된 ‘저탄소차협력금제도(案)’ 및 2014년 시작된 ‘친환경차지원사업’이 초래하는 자동차 산업의 가격 변화가 거시경제 변수 및 재정수지에 미치는 영향을 분석하였다. ‘저탄소차협력금제도’는 자동차 소비자가격을 인상시켜 자동차 산업의 생산 및 수입을 위축시키지만, 추가적인 세수를 소득세 감세 재원으로 활용하면 전반적인 타 산업 수요가 진작되어 거시적으로 성장촉진 및 고용확대 효과가 발생하였다. 반면 ‘친환경차지원사업’은 자동차 소비자가격 인하로 인해 자동차 산업 생산 및 수입이 촉진되지만, 재원 확보를 위한 소득세 부담 증가로 타 산업 수요가 전반적으로 위축되어 거시적으로 성장 및 고용이 위축되었다. 본 논문에서는 저탄소차협력금제도는 GDP 감소가 0.015% 인 반면, 친환경차지원사업은 0.104% 감소시키다는 것을 확인하였다. 이는 2014년도에 저탄소차협력금제도 대신 도입된 친환경차지원사업이 장기적으로 한국경제에 더 불리할 수 있음을 시사한다.

Keywords:

Clean Car, Bonus-Malus, Subsidy, Revenue Recycling, CGE, General Equilibrium Science키워드:

친환경자동차, 저탄소차협력금제도, 보조금제도, CGEI. Introduction

Korea’s policy to promote clean cars (pure electricity car and hybrid car) is mainly a subsidy (a price support) program. New clean car buyers in Korea can receive price discounts according to government policy. It was estimated that the public budget allocated to this policy increased 23.7% per year during 2013-2015 years. The 2015 budget for clean cars accounted for 33.2% of the total budget for the Ministry of Environment’s atmospheric sector.1) The policy, however, was criticized for having relatively little greenhouse gas reduction effect compared to the size of the budges. The greenhouse, which has been reduced by the Korea’s subsidy program, was estimated to account for only 0.1% of the total GHG emission reduction of the transportation sector in 2014.2) For this reason, the Korean government planned to implement a new clean car policy that mixes tax and subsidy, which is less budget burden. But the new policy was eventually delayed after a study, a partial equilibrium analysis, was released that the new policy (tax-subsidy program) may cause significant loss of both production and job in the auto industry without provoking significant reduction of GHG.

In this paper, we compare the current extended ‘subsidy only program’ with ‘tax-subsidy program’ by applying a general equilibrium model (the single country recursive dynamic CGE model) rather than the partial equilibrium model, and diagnose whether the government stock decision was right. We argue that the partial equilibrium assessment failed to consider the potential revenue–recycling effects of the tax–subsidy program and overestimated the economic cost.3) The previous study is based on partial equilibrium analysis, estimating market share of individual cars and simulating the change in car sales that would result from a planned tax–subsidy. While the previous one measures only the economic cost to the auto industry, it did not consider that the tax–subsidy plan generates its own revenue, which can then be used to mitigate the car–industry shocks. The subsidy-only policy, in comparison, should boost car sales and support the auto industry, but must tap on general tax revenue. It also does not have any self-mitigation mechanism like a revenue–recycling effect.

This paper is organized as follows. In section 2, we briefly review previous studies on clean car policy analysis. In section 3, we introduce our single–country recursive dynamic CGE model and apply this model to two Korean Clean Car policies–announced tax–subsidy plan in 2014, and the replacement Clean Car subsidy in 2015. Section 4 summarizes our results.

Ⅱ. Previous Literature

Previous research on clean car sales supports policies concentrated on greenhouse gas emission reduction. Most previous research applied discreet–continuous choice models4) to estimate sales and mileage of individual car brands (D’Haultfoeuille et al., 2010; Kwon et al., 2012; Glerum et al., 2015). This body of researches followed a two-step approach. First, the elasticity of car sales and mileage with respect to purchasing price and driving cost is estimated. Then, the policy’s greenhouse gas emission reduction effect is evaluated by estimating car sales and mileage changes following policy implementation and calculating consequential greenhouse gas emission changes. In estimating changes in car sales and mileage, the elasticities estimated in the first step are applied to the purchasing price change and driving cost change post the policy’s introduction.

Depending on the car demand to estimate and characteristics of regressors, studies may have either of the following approaches–‘Individual brand approach’5) and ‘car–consumer link approach’.6) The first considers only car brand characteristics in its estimation. This approach can obtain the demand for each individual car brand as far as the data permits. In addition, since this approach only needs car characteristics, nationally representative data can be constructed easily by surveying car producers. The second approach considers not only car brand characteristics but also consumer characteristics. It can include important consumer characteristics, such as household income, in demand estimation. Therefore, it may capture more realistic policy evaluations. However, this approach needs consumer survey data, which are not generally representative of nation-wide car sales and detailed individual car characteristics. To overcome this weakness, the second approach usually groups car data into a few large categories.

Both approaches have advantage in estimating greenhouse gas emission changes that arises from car sales and mileage changes. However, the economic effect evaluation is limited to effects on the car market. Clean car policies, however, are financed by government budget, and the size of budget and choice of the resource mobilization method should have macroeconomic consequences. Since these two approaches cannot take these macroeconomic consequences into account, they are not well suited for economic effect evaluation.

To overcome these limitations, we need general equilibrium analysis. However, computable general equilibrium (CGE) models are not actively used in previous research, because of their limitations when estimating greenhouse gas emissions from car sale and mileage changes. In general, the commodities in CGE are determined using Input–Output tables data, which do not have detailed car sales data broken down to individual car characteristics. Furthermore, mileage data cannot be directly identified in the CGE model, but should be derived from household fuel consumption. Transportation fuel consumption, however, is not generally disaggregated from household fuel consumption and should be estimated. Recently, a few preliminary trials have been made to overcome these limits using the EPPA model maintained by the Joint Program on the Science and policy of global change in MIT. These researches separated consumer transportation fuel demand from the rest, classified them into fuel demand for each car category (Paltsev et al., 2004), and then combined fuel demand for each car category with car demand (Karplus et al., 2013). In Korea, Kang and Kim (2014) used a similar approach to estimate the effect of a carbon tax on the choice between medium- and small-sized vehicles. These studies should be able to break down consumer fuel demand according to demand for each car category, but this categorization is mainly accomplished with consumer survey data, which might not be representative of the national population.

This paper extends this recent literature by using CGE to analyze the consumer transportation fuel choice. But, this paper only concentrates on the evaluation of macroeconomic consequences of clean car policy. We do not deal with consumer fuel demand changes and consequential greenhouse gas emission reductions, because the literature has arrived at a consensus on this issue. Therefore, it is pointless to disaggregate consumer car demand and transportation fuel demand for each car category. We use a simple CGE model with single car and fuel demand instead.

We used single country CGE model instead of global model because we are more interested in the difference of the effect of two programs on domestic macroeconomic variables such as GDP and employment. First, the double—dividend effect7) is general equilibrium effect, and it is usually measured using domestic macroeconomic variables. Second, the size of tax-subsidy program and subsidy-only program was too small8) to have significant effects on the trade variables even though the controversy regarding tax—subsidy program was mostly related to trade issue. The difference of the effects of two programs could be significant on domestic macro variables, such as GDP and employment. In this case, single country domestic CGE model can give more realistic insight, because we can construct the input data for domestic single country model using the Input-Output table on South Korea published by Bank of Korea. To construct global CGE model, we must rely on globally collected data such as GTAP (Global Trade Analysis Project)9) Data Base, which might not be as realistic as the Input- Output table on South Korea.10)

Ⅲ. General Equilibrium Analysis

1. Model

The CGE model used in this paper consists of 11 market agents–seven industries, households, government, savings–investment, and the rest of the world. Industries purchase intermediate goods from the commodity market and production factors from the household and use them to produce commodities.

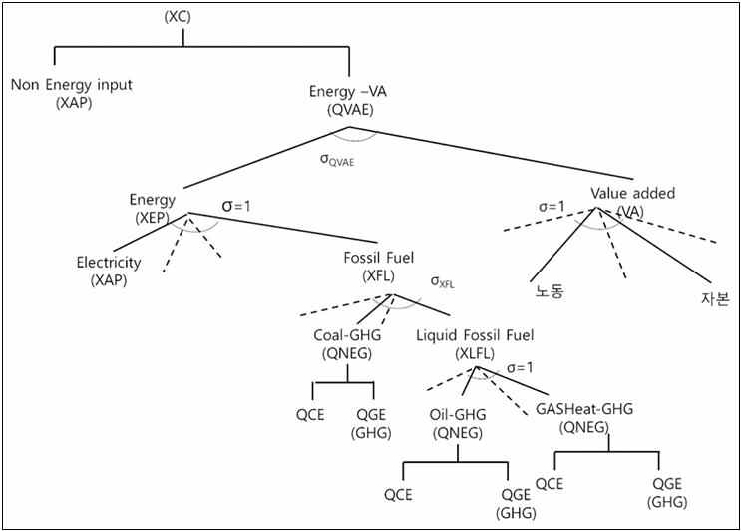

They pay production tax out of their revenue and get subsidies from the government. The seven industries11) are electricity, coal, oil, gas-heat,12) auto(automobile), energy intensive industry,13) non-energy intensive industry. Each industry’s production function has the same nesting structure presented in <Figure 1>.14)15) The commodities produced by industries and imports are consumed by industry, household, government, savings—investment agent, and the rest of world. The consumption by industries comprise intermediate demand. The consumption by households, government, savings–investment agents, and the rest of the world comprise final demand. Households pay income tax from factor income and government transfer payments. With the rest of total income – disposable income, households purchase commodities and save what remains. Government purchases commodities, provides subsidies to industries, and transfers income to households using tax revenue, and saves the rest.

The rest of world sells import, pays import taxes out of sales revenue, buys exports and saves the rest. Savings–investment collects savings from household, government, and rest of the world. Using all the savings, it purchases investment commodities for capital accumulation. Tax revenue for government consists of income tax proportional to household income, production tax proportional to commodity production, and import tax proportional to imports.

Commodity prices and factor prices are determined in the market. Industries determine domestic supply and export depending on the relative price of export and domestic supply.16) Domestic supply and import form an Armington Composite, and then supplied to domestic market. Each agent purchases Armington composite commodities to meet their intermediate demand and final demand. The prices of Armington composite commodities clears the commodity market. The demand for domestic supply and imports are determined by the level of Armington composite demand and the relative price for domestic supply and import.17) Factor prices clear the factor market. The interest rate matches the sum of capital demand for all industries and the supply of capital determined by the capital accumulation equation. The wage matches the sum of labor demand of all industries and labor supply is determined by a reduced form labor supply function below. We set the elasticity of labor supply to after-tax wage as constant.18) As is the case for all general equilibrium models, we need a numeria. We used CPI, the base–year–consumption weighted Armington commodity price, as our numeria and set it as 1.

Since market transaction cannot guarantee the budget balance of three non–market agents–government, rest of the world, and savings–investment, we needed closure rules for them. We set government savings to match the difference between revenue and expenditure. The income tax rate is adjusted to generate exact revenue changes, to cancel out revenue changes from tax subsidies on cars evaluated using before–tax car sales. In this way, we are able to evaluate the potential revenue recycling effect. All other tax rates are fixed. The household transfer is set as proportional to the population older than 65.19) To balance the rest of the world, we fixed the exchange rate at the base year value and let the trade balance – the negative savings – be adjusted to maintain a fixed exchange rate. This way, we were able to analyze the effects of the clean car policy on trade. Finally, we adjusted the sum of investment demand to match the sum of household savings, government, and the rest of the world.

This model is a recursive dynamic model. The law of motion consists of capital accumulation, population growth, and labor productivity change. The sum of current capital after depreciation and total investment final demand becomes the next period capital. Population growth20) changes labor supply. Labor productivity growth is calibrated to generate the 2015–2019 annual growth rate, mimicking the 2010–14 annual growth rate, namely, the growth rate during the four years before implementation.21)22)

We constructed the input data for our CGE model using 2010 basic price Input-Output table of South Korea (Bank of Korea, 2014) and National Account of South Korea (Bank of Korea, 2010) published by Bank of Korea. The 2010 basic price Input–Output table is the most recent available Input–Output table based on raw data.23) We used the basic price table to avoid price distortion due to producer’s tax. We can obtain base year values for most of the variables except for household income tax burden and government transfer payment to household. We use the 2010 National Account data. For income tax burden, we use the ‘current taxes on income and wealth, etc. item among the ‘source’ items of general government. It is 90.3 trillion KRW. To measure household transfer payments, we use the ‘Social benefits’ item among the ‘use’ items of general government. It is 43.4 trillion KRW (Bank of Korea, 2010).24)

2. Method

In this section, we analyze the general equilibrium models of two clean car polices described above– the postponed tax–subsidy plan in 2014 and the expanded clean car subsidy in 2015. We quantified the price shock from each policy and evaluated the consequential general equilibrium effect on key economic variables. To quantify the price shock, we evaluated the price change of weighted average car prices from each policy using 2013 sales as weight. Since the share of clean cars of domestically produced cars differ from that of imported cars, we evaluated both the price shock for domestically produces cars and the price shock for imported cars. To account for the revenue–recycling effect, we assumed that the income tax rate changes to guarantee ex ante revenue neutrality. The potential revenue gain evaluated using pre–policy car sales would be used to reduce the income tax rate. On the other hand, the potential revenue loss would be financed by increasing the income tax rate.

In conventional fiscal policy analysis, extra revenue is used for lump sum benefits and extra deficit is financed with lump sum tax to avoid relative price distortion. But in double-dividend effect analysis, we want to consider the effect of extra-revenue canceling out status quo distortionary taxes. For this reason, we used potential extra revenue to reduce income tax rate. And to make the effect of potential deficit comparable to the effect of potential revenue, we financed potential deficit by raising income tax rate.

Using this price shock and income tax rate change, we obtained the general equilibrium solutions for key variables with and without a clean car policy shock. Our measure for the general equilibrium effect is the percentage change of key variables from both clean car policies compared to the solutions without a clean car policy shock. The price shocks are calculated as we describe in 3.2.1 and 3.2.2. We run our CGE model for 2015, a single year, and we run it recursively for 2015–2019. The results were qualitatively equivalent. We mainly present the dynamic results.

The price shock from the 2014 tax–subsidy plan is quantified as follows: The tax–subsidy is determined according to the 2015 CO2 emission per kilometer estimates and fuel. The tax–subsidy schedule of the 2014 tax–subsidy plan is provided in table 1.25) The second column of <Table 1> indicates the main fuel of the car, the third and fourth column indicates the upper and lower bound of 2015 CO2 emission per kilometer estimates. And the last column is the amount of tax or subsidy assigned to the cars with the fuel at second column and the 2015 CO2 emission per kilometer estimates are between the third and fourth column. Positive numbers on the last column shows the size of subsidy, negative numbers show the size of tax.

The change in car prices due to the tax–subsidy schedule in Table 1 is defined as the change from the 2013–sales–weighted average of car prices. The 2013 car sales and price are obtained from 2013 car sales data of 395 car brands from 20 car companies. This data is used to estimate changes in car sales as a result of the 2014 tax–subsidy plan. It contains data on CO2 emissions per kilometer, monthly sales, and monthly sales prices. The car price change is derived as follows:

STEP 1 Following the Korea Institute of Public Finance (2014), we assumed that the CO2 emission per Kilometer would decrease by 3% due to autonomous energy saving technical progress. Applying this assumption, we estimated the 2015 emission of each car brand as follows. Then, we assigned the tax and subsidies in Table 1 based on the 2015 emission estimates to obtain price changes for individual car brands.

STEP 2 The tax and subsidies assigned in STEP 1 are converted into 2013 prices using the producer’s price index for domestically produced cars and the import price index for imported cars.26)

STEP 3 The price change of auto industry resulting from the tax–subsidy plan is obtained by computing the change in the 2013–sales–weighted average car prices.

The price changes due to the 2014 tax–subsidy plan obtained from STEP1 to STEP3 was 0.745% for domestically produced cars, and 0.716% for imported cars. This result implies that consumers pay 0.745% higher prices for domestically produced cars and a 0.716% higher price for import cars. Since consumer prices for domestically produced cars and imported cars are changed, the Armington composite price for cars, market demand for domestically produced cars, and the market demand for imported cars are changed as follows:

● Armington composite price27)

● Market demand

For the 2014 tax–subsidy plan, is set as -0.00745, and is set as -0.00716.

The 2015 Clean Car Subsidy provides subsidies28) to consumers of hybrid cars or electric cars. The subsidies are set as 1.013 million KRW (962.0 US$) for hybrid cars, and 20.416 million KRW (19,388.4 US$) for electric cars. We found that four hybrid car brands29) and two electric car brands30) in our dataset are qualified for the 2015 Clean Car subsidy.31)

We converted these subsidies into the 2013 price level using producer’s price index and import price index, as we had in STEP2. We changed the 2013 sales price of 6 brands mentioned above and obtained the price change in car markets due to the 2015 Clean Car subsidy using the 2013 sales as weights, as we did in STEP3. We find that the domestic car consumer prices would fall by 0.0868%, and that imported car consumer prices would decrease by 0.0195%. For the 2015 Clean Car subsidy policy, is set as 0.000868, and is set as 0.000195.

3. Results

As expected, the 2014 tax–subsidy plan would cause a 6.94%32) decrease in domestic car production in 2019. But the extra tax revenue would cut effective income tax rate by 0.07%p from 9.62% to 9.55%. This tax cut would be enough to boost domestic production of other industries by 0.06% to 0.46%.

Overall, the positive effect on the output of other industries would be larger than the negative effect on the auto industry so that GDP and total employment would improve mildly. This positive macroeconomic effect would improve the budget balance and government savings. Increased government savings would accelerate capital accumulation and output and government savings would increase further as time goes on. 2014 tax–subsidy plan would increase the 2019 GDP by 0.108%,33) total employment by 0.010%, and government savings by 1.939%.

Our general equilibrium analysis confirms the results of partial equilibrium analysis qualitatively, by showing that auto industry outputs would decrease significantly. Our analysis, however, also shows that the revenue–recycling effect could be sufficiently large to compensate for losses in the auto industry and deliver positive macroeconomic outcomes. On these bases we claim that partial equilibrium analysis overestimated the potential negative effects of the 2014 tax–subsidy plan.

The 2015 Clean Car subsidy would increase 2019 car production by 0.87%. But, because of the extra tax burden necessary to finance the clean car subsidy, overall demand for other industries would decrease. The 2015 Clean Car subsidy would increase the effective income tax rate by 0.01%p–from 9.62% to 9.63%. And the consequential decrease in disposable income would lead to a 0.0057%–0.016% decrease in domestic production of other industries. The effects on imports would vary.

Overall, our analysis suggests that domestic production increases in the auto industry would be exceeded by the macroeconomic effect of decreased production in other industries. GDP and total employment would slightly decrease. And output decreases would affect tax revenue, government budgets, and government savings. Dynamically, decreases in government savings would slow down capital accumulation. GDP and employment decreases would worsen over time due to slow capital accumulation. Our analysis suggests that the 2015 clean car subsidy would decrease GDP by 0.015%, total employment by 0.0014%, and government savings by 0.265% in 2019.

4. Sensitivity Analysis

To check if our result is robust to tax-subsidy size, we performed sensitivity analysis with alternative taxes and subsidies. If our result does show the macroeconomic advantage of the revenue recycling effect of tax-subsidy plan, then the effect on industrial production on <Table 3> and the macroeconomic effects on <Table 4> should be robust to minor changes on the tax-subsidy level on <Table 1>. And the results on <Table 3> and <Table 5> should be robust to minor changes on the subsidy size of 2015 subsidy only plan.

For the sensitivity analysis for the 2014 tax-subsidy plan, we randomized the 2014 tax-subsidy schedule by adding random shock generated from uniform distribution to the tax and subsidy of each class on <Table 1>. Except for the class 1, 2 and class 10, the upper limit of the shock was the midpoint of the difference between the tax or subsidy for the former class and the tax or subsidy of its own class. And the lower limit of the shock was the midpoint of the difference between the tax or subsidy for the latter class and the tax or subsidy of its own.

Since the subsidy for the class 1 was higher by 5 times than the subsidy for class 2, applying the rule used for class 3 to class 9 to the upper and lower limit of the shock to class 2 would generate much larger shock to the subsidy for class 2, so we set the upper limit of the shock to class 2 as 50, to make it symmetric to the lower limit. We also set the lower limit of the shock to class 10 as -50 to make it symmetric to the upper limit. Finally, we set the upper and lower limits of the shock to class1 as 50 and -50, since 50 and -50 was most frequently used for the upper and the lower limits for the shocks for other classes. The uniform distributions we used to generate random shock to the tax or subsidy on each class are on Table 6. We generated 100 alternative tax-subsidy schedule by adding shocks generated from the uniform distribution on Table 6 to the original tax-subsidy.

For the sensitivity analysis for the 2015 subsidy only plan, we tried to generate subsidy shock similar to the subsidy shock used in the sensitivity analysis for the 2014 tax-subsidy plan. The subsidies for the first and the second class of the 2014 tax-subsidy plan are subsidies for electric cars and hybrid cars. Since the 2015 subsidy only plan only subsidize prices for electric cars and hybrid cars, we want to generate subsidy shocks for electric cars and hybrid cars that are comparable to the subsidy shocks for the first two classes used in the sensitivity analysis of the 2014 tax-subsidy plan.

To do that, we calculated the ratio of the alternative subsidy to the original subsidy at the first and second class in the 2014 tax-subsidy plan sensitivity analysis. Then we multiplied the average subsidies for electric cars and the hybrid cars in the 2015 subsidy only program with the alternative subsidy to the original subsidy ratio of the first and the second class from the sensitivity analysis of the 2014 tax-subsidy plan, and used that for our alternative subsidies in the sensitivity analysis for the 2015 subsidy plan. In this way, we kept the ratio of the alternative subsidy to original subsidy in the sensitivity analysis for 2015 subsidy only plan identical to the alternative subsidy to original subsidy ratio in the sensitivity analysis for the 2015 subsidy only plan.

Then we applied the process to calculate domestic price shock and import price shock from tax-subsidy schedule described in section 3.2. to all the alternative tax-subsidy schedule. Using these price shocks from alternative tax-subsidy schedule, we performed general equilibrium analysis. Then we obtained industry output, GDP, government saving and labor supply from general equilibrium results from alternative tax-subsidy schedules. And then calculated percentage deviation of each variable compared to the corresponding values without price shock.

<Table 7> reports sample statistics of the price shocks used in our sensitivity analysis. A positive shock implies that the tax-subsidy schedule imposed net tax, and a negative shock implies that the tax-subsidy schedule imposed net subsidy. <Table 7> shows that most of alternative tax-subsidy schedules used in the sensitivity analysis for the 2014 tax-subsidy plan worked as net taxes. And all alternative subsidies used in the sensitivity analysis for the 2015 subsidy only plan worked as net subsidies. Only two out of 100 alternative tax-subsidies had negative effect on the domestic car price. For all alternative tax-subsidy schedule, no one had negative effect on the import car price. For all 100 alternative subsidies for the 2015 subsidy only plan, no subsidies have positive effect on either domestic price or foreign price.

<Table 8> shows the industry specific result of the sensitivity analysis for the 2014 tax-subsidy plan. It reports mean, 95% interval, and percentage of positive observation of the deviations of domestic output of each industry from corresponding values without tax or subsidy. The result on <Table 8> is consistent with the results on <Table 2>. In 98% of cases, tax--subsidy plan had negative effect on the Auto industry production, but it had positive effect on the production of the other 6 industries.

<Table 9> shows the results of sensitivity analysis for the 2014 tax-subsidy plan on three macroeconomic variables on <Table 3>.34) Table 9 reports the mean, 95% interval, and percentage of positive observation of the deviation of three variables from corresponding values without tax or subsidy. Again, we can see the revenue-recycling effect is realized in 98% of the cases. The extra tax revenue improved government savings, increased employment and GDP. Actually, the two cases when the revenue-recycling effect were not realized were the cases when the tax-subsidy schedule worked as subsidy, not tax. In those cases, there were no extra revenue to create revenue recycling effect.

<Table 10> shows the industry specific result of the sensitivity analysis for the 2015 subsidy only plan. It reports mean, 95% interval, and percentage of positive observation of the deviations of domestic output of each industry from corresponding values without tax or subsidy. The result on Table 10 is consistent with the results on <Table 4>. In all cases, subsidy only plan had positive effect on the Auto industry production, but it had negative effect on the production of the other 6 industries.

<Table 11> shows the results of sensitivity analysis for the 2015 subsidy only plan on three macroeconomic variables on <Table 5>.35) Table 11. reports the mean, 95% interval, and percentage of positive observation of the deviation of three variables from corresponding values without tax or subsidy. Again, we can see the effect of the subsidy only plan on macroeconomic variables is negative. The tax increase to finance the extra subsidy revenue resulted in loss in GDP, government savings and employment.

The result of sensitivity analysis shows that the revenue-recycling effect on <Table 3> and <Table 5> are robust to the specific size of the tax and subsidy. This revenue-recycling effect was realized in 98% of the 2014 tax-subsidy plan sensitivity analysis. No tax-subsidy plan without extra-revenue could improve GDP or employment due to the extra tax-burden. All sensitivity analysis with net subsidy on car price (two cases of the 2014 tax-subsidy plan sensitivity analysis and all cases of the 2015 subsidy only plan) had decrease in GDP and in employment.

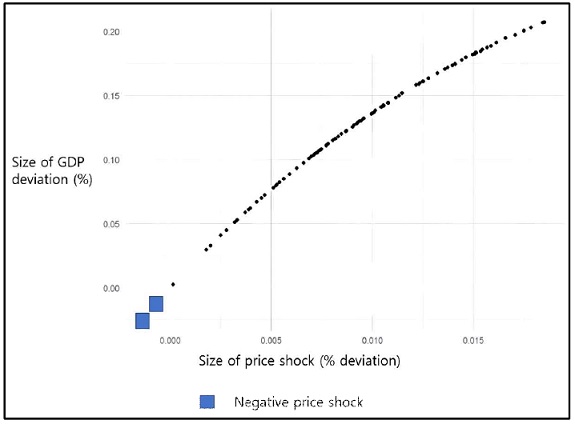

Our sensitivity analysis suggests that the existence of revenuerecycling effect depends on the design of tax-subsidy plan, not the specific size of tax-subsidy. If a tax-subsidy schedule would increase after-tax car price, then the extra revenue could be used to improve GDP and employment. As we can see from <Figure 2>, the size of tax and subsidy can affect the size of revenue-recycling effect, but not the existence of the revenue-recycling effect. <Figure 2> Shows the relationship between the size of price shock and the size of percentage deviation of GDP in the sensitivity analysis for the 2014 tax-subsidy plan. The size of the price shock was positively correlated with the size of deviation of GDP. But GDP decreased only when the price shock was negative.

5. Discussion

Our analysis suggests that the general equilibrium effect of two Clean Car policies were large enough to reverse the partial equilibrium effect. The 2014 tax–subsidy plan would work as a de facto consumption tax, while the 2015 Clean Car subsidy would work as a consumption subsidy. The 2014 tax–subsidy plan would have a negative effect on the auto industry, while 2015 Clean Car subsidy would have positive effect. The 2014 tax–subsidy plan, however, would have a positive revenue–recycling effect, while the 2015 Clean Car subsidy would have a negative general equilibrium effect. Dynamically, the static general equilibrium effect would change government savings and capital accumulation paths to amplify the general equilibrium effect.

Overall, the 2014 tax–subsidy plan seems to have harmful effect on consumer car prices and domestic car production, compared to those of 2015 Clean Car subsidy program. The macroeconomic consequences, however, would be the opposite. The revenue–recycling effect of 2014 would be large enough to overcome the negative impacts on the auto industry. The extra revenue was used for tax cuts, which have positive effects on other industries. The latter positive effect would overcome the former negative effect to the extent that GDP, employment, and government budget balances would improve. The implicit tax burden to finance the 2015 Clean Car subsidy would be large enough to overshadow the positive effect on the auto industry. The 2015 Clean Car subsidy would cause tax increases, which have negative impacts on other industries. The former positive effect would not be adequate to make up for the latter negative effect. As a consequence, GDP, employment, and government budget balances would decrease.

The change in government balance would change capital accumulation paths to amplify the static equilibrium effect. The 2014 tax–subsidy plan would improve government savings and accelerate capital accumulation. The increase in GDP and employment would rise in later years. The 2015 Clean Car subsidy would decrease government savings and decelerate capital accumulation. The decrease in GDP and employment would be greater in later years.

Our analysis suggested that the partial equilibrium effect and the general equilibrium effect could work against each other. Two Clean Car policies would cause price shocks to the auto industry, and result in the expected partial equilibrium effect. At the same time, both policies would change overall tax burdens, resulting in opposite effects for other industries. The overall impact would be the sum of these two effects. Our analysis shows that the change in disposable income due to revenue–recycling could yield a general equilibrium effect to overcome the effects on the auto industry.

Ⅳ. Conclusion

In this paper, we challenged the economic argument that resulted in the Korean Clean Car Policy swap in 2014. Applying general equilibrium analysis, we found that the 2014 tax–subsidy plan would be able to yield positive revenue–recycling effects large enough to compensate for the losses by the auto industry. On the other hand, the 2015 Clean Car subsidy that replaced 2014 tax–subsidy plan could have harmful general equilibrium effects due to an implicit tax burden. Therefore, the South Korea clean car policy swap in 2014 may have done more harm than good to the Korean economy.

Specifically, the 2014 tax–subsidy plan would have raised tax revenue that could be used to cut tax burdens, while the 2015 Clean Car subsidy would need extra revenue to increase tax burdens. This change in tax burdens would lead to shifts in production in other industries which would be large enough to make up for the production changes in the auto industry and determine macroeconomic outcomes. Considering this general equilibrium effect, we found that the 2014 tax–subsidy plan would improve GDP, employment, and capital accumulation, while the 2015 Clean Car subsidy would decrease GDP, employment, and capital accumulation, however these effects might be small.

Our results show that a tax–subsidy plan evaluated on partial equilibrium analysis may be misleading. The partial equilibrium analysis disregards potential revenue–recycling effects that could mitigate the policy shock on the auto industry. Disregarding this potential revenue–recycling effect would unduly favor subsidy–only policies over tax–subsidy plans. So, general equilibrium analysis is needed for a more balanced assessment.

Our results can be extended in two ways. First, our analysis shows that tax–subsidy plan could have revenue–recycling effects similar to the double–dividend effect of carbon tax. The double dividend effect, however, can vary according to the way extra revenue is spent. We assumed that the revenue from the 2014 tax–subsidy plan would be used for income tax cuts, but it could be used in various ways–per capita transfer payments, government spending, government savings, and so on. It would be interesting to observe which way of spending extra tax revenue would be most favorable to overall economy.

Second, our analysis also suggests that a price shock on industries with long value chain like auto industry could have a significant macroeconomic impact. We believe this result represents a possible shock propagation mechanism through inter-industry subcontract network. It would be interesting to find out which part of subcontract network should be vulnerable to the price shock on the final output. Our CGE model could be modified for this task by disaggregating key industries connected through subcontract network.

Acknowledgments

This work was supported by the Ministry of Education of the Republic of Korea and the National Research Foundation of Korea (NRF-2016S1A5A8018714).

References

- Bank of Korea, 2010, National accounts 2010, (Technical Report), Seoul: Bank of Korea.

- Bank of Korea, 2014, 2010 Input–Output statistics, (Technical Report), Seoul: Bank of Korea.

- Chang, K. B. and Y. K. Kim, 2008, Economic impacts of international greenhouse gas emission trading, (KEI; RE-11), Seoul: KEI.

-

D’Haultfoeuille, X., I. Durrmeyer, and P. F´evrier, 2010, “What did you expect? Lessons from French bonus/malus,” Revue E’conomique, 62(3), pp.491-499.

[https://doi.org/10.3917/reco.623.0491]

-

De Jong, G. C., 1990, “An indirect utility model of car ownership and private car use,” European Economic Review, 34(5), pp.971–985.

[https://doi.org/10.1016/0014-2921(90)90018-T]

-

Dubin, J. A. and D. L. McFadden, 1984, “An econometric analysis of residential electric appliance holdings and consumption,” Econometrica, 52(2), pp.345–362.

[https://doi.org/10.2307/1911493]

-

Fullerton, D. and G. E. Metcalf, 1997, Environmental taxes and the double-Dividend hypothesis: Did you really expect something for nothing?, (NBER Working paper No.6199), Cambridge, MA: National Bureau of Economic Research.

[https://doi.org/10.3386/w6199]

- Greenhouse Gas Inventory and Research Center, 2018, 2018 national greenhouse gas inventory report of Korea, Seoul: Greenhouse Gas Inventory and Research Center.

- Glerum, A., O. B. Västberg, E. Frejinger, A. Karlström, M. B. Hugosson, and M. Bierlaire, 2015, A dynamic discrete-continuous choice model of car ownership, usage and fuel type, (Cirrelt-2015-23), Montréal, Québec: CIRRELT (Interuniversity Research Center on Enterprise Networks, Logistics and Transportation).

- Kang, H. C., S. W. Kang, Y. C. Koo, H. K. Kim, Y. K. Kang, and J. W. Lee et al., 2015, 2015~2019 national budget planning: Environment, Sejong: Ministry of Economy and Finance.

- Kang, S. W. and M. J. Kim, 2014, An environmental outlook of Korea–KEI integrated assessment model build up, (Climate Environment Policy Research 2014-01), Sejong: KEI.

-

Karplus, V. J., S. Paltsev, M. Babiker, and J. M. Reilly, 2013, “Applying engineering and fleet detail to represent passenger vehicle transport in a computable general equilibrium model,” Economic Modeling, 30, pp.295–305.

[https://doi.org/10.1016/j.econmod.2012.08.019]

- Korea Institute of Public Finance, 2014, Research on clean car tax–subsidy program adjustment, Sejong: Korea Institute of Public Finance (unpublished manuscript).

- Korean Hybrid model developing team, 2016, 2015 annual report–project manager, Sejong: Korean Hybrid model developing team (unpublished manuscript).

- Kwon, O. S., Y. G. Kim, and, J. H. Jung, 2012, “Analysis on the effect of clean car policy on the energy consumption and CO2 emission using discrete–continuous choice model,” Environmental and Resource Economics Review, 21(2), pp.237–269.

- Ministry of Environment, 2015.2.5., “Clean car subsidy expansion,” Press Release.

- The National Assembly of The Republic of Korea, 2014, 2014 annual budget, Seoul: The National Assembly of The Republic of Korea.

- The National Assembly of The Republic of Korea, 2015, 2015 annual budget, Seoul: The National Assembly of The Republic of Korea.

- Paltsev, S., L. Viguier, M. Babiker, J. Reilly, and K. Tay, 2004, Disaggregating household transport in the MIT-EPPA model, (Technical Note No. 5), Cambridge, MA: Joint Program on the Science and Policy of Global Change.

- GTAP (Global Trade Analysis Project), https://www/gtap.agecon.purdue/default.asp, .

- Statistic Korea, Korean statistics information service, 2017, http://kosis.kr, /.

- Bank of Korea, Economic statistics system, 2017, http://ecos.bok.or.kr, /.

Sung Won Kang: He earned a Ph.D. in Economic History from Rutgers, the State University of New Jersey in the U.S. After serving as a researcher at Samsung Economic Research Institute, and a senior researcher at Korea Economic Research Institute, he has been with Korea Environment Institute since 2011. Major areas of interest include computable general equilibrium model, greenhouse gas emission mitigation policy, machine learning, and public finance. His major report includes Kang et al. (2017) "Big Data Analysis: Application to Environmental Research and Service”, Kang et al. (2018) "Big Data Analysis: Application to Environmental Research and Service (II)”, and Kang et al. (2019) "Big Data Analysis: Application to Environmental Research and Service(III)” (swkang@kei.re.kr).

Hee Chan Kang: He earned a Ph.D. in Resources, Environment and Economics from Ohio State University in the U.S., and Samsung Economic Research. After serving as a senior researcher at the institute and a researcher at the Korea Institute for Environmental Policy Evaluation, he has been a professor of economics at Incheon National University since 2014. Major areas of interest include climate change policy and valuing environmental goods, and his major papers include Kang (2019) "An Analysis of the Causes of Fine dust in Korea Considering Spatial Correlation” (Henrykang@inu.ac.kr).